How To Set Purposeful Financial Goals For Your Small Business22 min read

Setting financial goals for your small business can feel… complicated. On the one hand, you want to shoot for the moon, land among the stars, and make more money than you ever thought was possible. On the other hand, if it were as easy as snapping your fingers you’d have done it by now, there’s a lot that goes into generating sustainable income in your business, you don’t want to set a goal and fail at it and you certainly don’t want to burn out in the process of chasing some arbitrary number.

So how do you set the right financial goals for your small business?

Money has become a way of keeping score, not paying for the experiences we desire.

Toxic Wealth

As a business coach, I help high achieving entrepreneurs grow their businesses without burnout. Through my work, I see so many entrepreneurs set financial goals in a way that’s harming their business, killing their motivation, and setting them up for failure.

There’s a better way to set financial goals for your business than picking a big fancy number that makes your ego feel good.

The most common financial goal setting mistakes

Here’s what I see happen most often when entrepreneurs go to set goals:

- They pick an arbitrary number out of thin air because they feel they’re supposed to have one

- They pick an astronomically huge number because they’re trying to prove something to someone and boost their ego in the process

- They don’t set a financial goal at all and just focus on getting through the to do list instead

- They set a goal they already know they’re going to reach and stay inside their comfort zone

If any one of these applies to you, it’s time to implement a better method of setting financial goals in your small business.

If you aren’t sure where you need to focus in your business for the upcoming year take our personalized quiz here!

Why most small business owners are setting financial goals all wrong

The spirit of entrepreneurship is about fulfillment.

The coaching clients I work with all started their businesses because they love the work and want to spend their lives doing it. They are purpose driven entrepreneurs with a passion for their mission.

But lately, more and more entrepreneurs are taking something they used to be wildly passionate about, and turning it into another rat race to wealth. Business owners are chasing the next big number at the expense of everything else that matters to them. They’re sacrificing their health, their happiness, their relationships… and they are burning out.

In fact, 1 in 3 entrepreneurs are dealing with burnout as they run their small business (Linder, 2023).

To be fair, entrepreneurship IS about the money… The business needs to make money to exist, and you need to make money to support yourself.

The real question is how much money do you want? And for what?

Setting purposeful financial business goals isn’t about “10xing” or “doubling” or “making a million dollars.” Those things all look nice on paper, but they’re meaningless unless there is a purpose behind the money you’re chasing.

Setting purposeful financial goals is about supporting the things you desire to have and experience in business and in life.

Related Post: How to Recommit to Your Goals

The problem is, most of us don’t know what that is.

Before I help you uncover the right financial goal for your small business this year, you need to know

- The types of financial goals you can set for your business

- The reason it’s so important to set financial goals for your business

- The mindsets and beliefs that prevent us from setting purposeful financial business goals

This will help you understand what you need to shift in your own business goal setting process in order to set the right financial goals for your business this year, feel more ease and joy in the journey of achieving them, and create a purposeful business that supports the most fulfilling version of your life.

Types of Money Goals

There are many different types of financial goals you can set for your business, but the most common financial goals focus on revenue and profit.

Revenue Goals focus on increasing the total income generated from your products or services. It’s the top line number that comes before all your other expenses.

Profitability Goals focus on ensuring that your revenues exceed your expenses by a healthy amount. It’s the bottom line number after all of your other expenses, and it determines whether you’re keeping most of the money that you’re making (or not).

Other financial goals can include

- Cash Flow Management Goals focus on ensuring you have enough cash in the business at all times to cover the expenses required to operate your business

- Debt Reduction Goals focus on reducing the level of debt or improving the debt-to-equity ratio (by paying down loans or negotiating better terms).

- Exit Strategy Financial Goals focus on selling your business for a healthy amount when succession planning.

What is the right type of financial goal to set for my business?

The right type of financial goal to set will depend on your business and the stage you’re in.

If you’re just getting started, your focus is going to be on selling your products/services and making money: a revenue goal is the place to start.

If you’ve been in business for a while and are consistently generating income, you may want to look at your profit margins to ensure you’re keeping as much as possible of the money you’re generating. No business will ever be 100% profitable, but you certainly want your profit margins to remain high.

In the end, you’ll probably set a goal for both as your profit is tied to your revenue, after all.

The Reason To Set Financial Goals For Your Business

You might be wondering if you really need to set a financial goal for your business. After all, can’t you just focus on doing good work and the rest will come?

Yes and no. Focusing on doing good work is absolutely critical. But not having a financial goal prevents you from making the strategic decisions required to achieve it. (Plus, it’s not as motivating.)

Financial goal setting as a motivational tool

Goal setting is a powerful strategy to give you direction, focus, and motivation in your business and life. Research performed by Edward Locke, renowned goal setting expert, revealed that goal setting was a powerful motivational tool, leading to increased performance (Locke, 1968).

Your goals will span many areas of your business over time: you’ll set process improvement goals, customer experience goals, team goals, sales goals, etc. But the one type of goal you will always set for your business is a financial goal.

Entrepreneurship is many things, but at its core it’s the ability to make money in exchange for products or services. Which is why financial goals will always be a part of your business goal setting process.

But why is it so important to set financial goals for your business?

Related Post: The Ultimate Guide to Setting Goals and Achieving Personal Growth

Financial goal setting as a strategic tool

Setting financial goals for your business is the foundation of your strategy.

If you aren’t clear on the size of business you’re aiming to grow, it’s going to be mighty difficult to do the right things to get there.

N was a client of mine with 2 part time team members generating about $100,000+ in revenue. He hired me as his business coach to help him hit his ideal stage in business: $750,000 in annual revenue. In working together, we uncovered that his business could not produce or sustain that level of revenue because he had neither the team capacity nor the processes and systems to execute on that amount of work.

Setting a clear financial goal helped N realize that what got him to his current level of business was not going to get him to the next level. We identified the biggest gaps that he needed to address and built a strategy to get him from 6 figures to multiple 6 figures. His income began to rise as soon as he started implementing these strategies.

So, the reason it’s so important to set financial goals for your business is not to “push yourself beyond your comfort zone” or “manifest it through magical thinking”…

Setting financial goals informs the real world strategies you’ll need to implement in your business in order to achieve your business vision.

After you’ve set your financial business goal, you can strategize the amount of team, processes, systems, infrastructure, etc. that you will need to make it happen.

Without a financial goal, all of that remains up in the air, and you fall short of your full potential because you can’t proactively move toward the vision you have for your business.

The Mindset Around Financial Goals

The biggest reason setting financial goals is hard for most entrepreneurs is because of the complicated mindset we tend to have around it.

“If I don’t hit my financial business goal, I’ve failed…”

High achievers get really invested in their goals. In fact, they come close to tying their identity to their goals. Which means they feel a lot of pressure to achieve those goals, and if they don’t achieve them, they feel like they’ve failed.

When they fail, they take it really hard because it puts cracks in their sense of self and their identity… they stop seeing themselves as successful and start seeing themselves as failures.

The goal becomes not just a goal to shoot for, it becomes a part of themselves that they can’t let down. This makes goal setting really complicated.

If this sounds like you, the first thing you need to do is shift your mindset around failure. There is absolutely nothing wrong, abnormal, or bad about not hitting your financial goal. It’s an opportunity to reevaluate the gaps and continue moving forward.

Goal setting is not about achieving the goal, it’s about working toward the goal, knowing you’ll go further than you would have without it even if you don’t hit it.

Ana McRae

The easiest way to shift your mindset around your goals is to remove the timeline from your financial goals. You don’t have to hit them this month, this quarter, or this year. You just have to hit it at some point.

Related Post: How to Master Your Mindset and Grow Your Business

When you’re setting purposeful financial goals, they aren’t dependent on time. You want what you want and you’ll work toward it until you get it. End of story.

“What if I set a goal that’s ‘unrealistic’?”

I don’t believe your goals need to be realistic and I go much more in depth on that in this article. There is no such thing as realistic when it comes to business. The entire premise of entrepreneurship is that you’re willing to do something that most others won’t. That applies to your financial goals too. If Ryan Kaji can make $20,000,000 a year unboxing toys, you can achieve whatever financial goal sounds wild and crazy to you right now, believe me.

As a business coach, I’ve helped entrepreneurs achieve their 5 year goals in 8 weeks, double their year over year revenue, and secure 70% of their annual revenue in the first month of the year. Anything is possible.

If you want support achieving your ‘unrealistic’ business goals, book a discovery call to explore how my 1:1 coaching process will help you elevate your business game.

Arbitrary targets

The last thing that gets in the way of entrepreneurs setting purposeful financial goals for their business is the common practice of choosing an arbitrary target for no specific reason at all.

In fact, I used to do this in my own business.

When I first started coaching and didn’t have a single client, I wanted to make $100,000 a year in profit. 9 months after quitting my day job, I hit that number, and immediately set a goal of $250,000 a year in personal income… why? There was no real reason. Just that a quarter million dollars ‘sounded nice.’ In reality, it wouldn’t actually change anything in my day to day life experience, but it created a sense of failure when I didn’t hit it.

These kinds of arbitrary financial goals hurt your motivation, chip away at your self trust, and prevent you from having the kind of life experience and work life balance you truly desire.

Knowing What You Want The Money For

Goal setting is motivating only when it means something to us.

Let’s use the classic weight loss example: if you set a goal to lose 20 pounds, it doesn’t actually mean anything to you and you won’t be motivated to achieve it. However, if you tie your goal into your ‘why’ – let’s say to fit into your sparkly new year’s eve dress and turn heads when you walk in the room, or to be able to keep up with your teenage sons playing basketball for hours in the driveway – your goal will generate an emotional response that drives real action.

The same is true for your financial goals.

A number is just a number that you have no attachment to. Your financial goal must be a number that represents something so specific and clear to you that you get excited just looking at it.

How to set financial goals for your business

The way to set purposeful financial goals for your business is to get very specific on what you want that money for, both in your business and in your personal life. Let’s walk through the step by step process of how to do that.

Step 1 Brainstorm all the things you want for your business

Let’s start with the business. What do you wish was different in your business?

Maybe you really want a shiny new website designed by a real web designer, or new professional photos to use in your marketing. Maybe you want to upgrade your office space, or your laptop, or invest in a software that will make your business so much easier to run. Maybe you want a new team member, or a business coach, or to take a specific program or training. Maybe you want a private jet to go visit your clients around the world.

Brainstorm a list of all of the things (big and small) you wish you had in your business.

Step 2 Brainstorm all the things you want for your life

Then do the same with your personal life. What experiences do you want to have or what things do you want to own?

Maybe you want to take multiple trips overseas each year. Maybe you want to unplug for a month. Maybe you want to buy land and build your dream home, buy a boat, or renovate your kitchen. Maybe you want a Peloton, new patio furniture, or a house cleaner.

Brainstorm everything (big and small) you want your business to provide for your life.

Step 3 Figure out how much all of that would cost

When you know what you want in your business and life, you can figure out how much it will cost to get there. That becomes the basis of your financial goals for your business.

Calculate approximately how much each of the above will cost you.

Getting a specific number is important (it makes it more real) but don’t get carried away here. Round to the nearest thousand or hundred and move on.

Step 4 Add it up & sanity check it

Take all of the numbers you calculated above and add them up. Then sanity check: does this feel like a good financial goal for your business?

When I say ‘good’ I mean it’s a goal that feels stretchy/not comfortable or easy, but achievable if you set your mind to it.

For example, if you made $500,000 in your business last year, and your list of things adds up to $510,000 this year, that’s probably too easy to really motivate you. (Unless you were to add in a different factor, like the same amount of money but working half the hours).

However, if you made $75,000 in your business last year, and your list of things adds up to $750,000, that’s probably too big of a jump.

Either way, make sure your financial goal aligns with your values and what fulfills you.

More isn’t always better. If your list of what you truly want ends up costing LESS than what you’re already making, that’s absolutely fine. It would be irrelevant to set a goal that’s bigger when your business is already creating enough cash to support your deepest desires.

Instead of setting an arbitrary / lofty financial goal, look at how you can lean into the experiences you desire more instead of working more. Take the trips you actually say you’ll take when you make X amount of money. Buy the yacht you keep telling yourself you’ll buy after you achieve X wild and crazy goal.

If you can’t think of what those things are, reassess whether you deeply desire something more that you aren’t admitting to yourself.

What would the most fulfilling version of your life look like?

Breaking Down Your Financial Business Goals

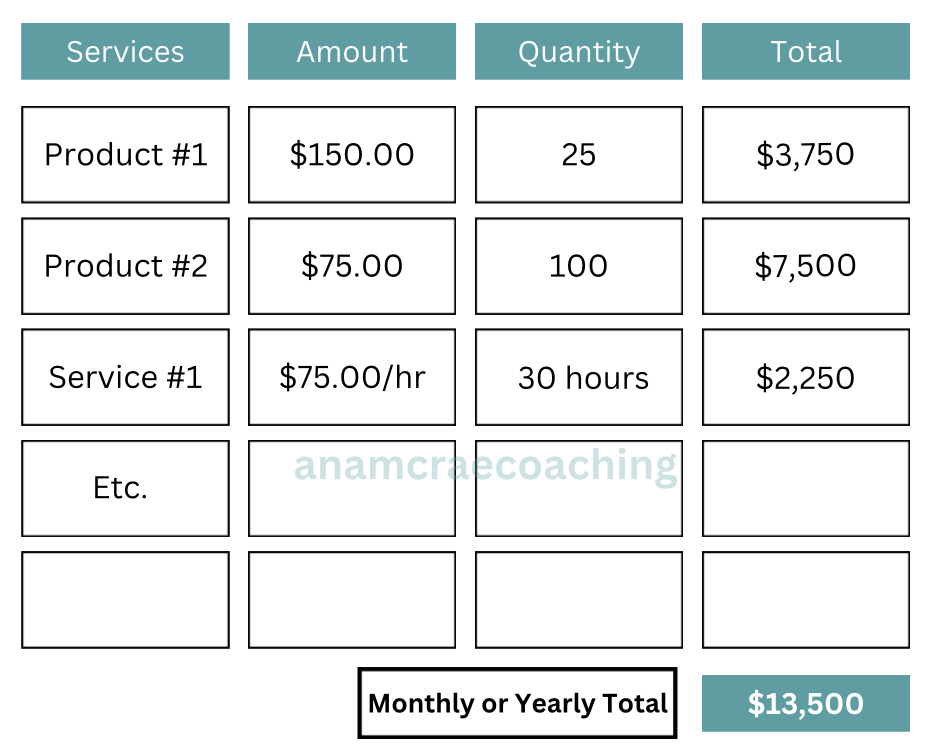

Once you’ve set your financial goals for your business, it’s critical that you break that big number down into an actionable plan.

The money is ultimately not within your control, but the products and services you sell to create that money absolutely are.

Take your financial goal and map out what a sales plan would look like to hit it.

A simple way to do this is to list all of your products and services in one column, their cost in another column, and how many you plan to sell in a third column, then create a simple formula to multiply and add it all up into one big number, which should match your financial goal. If it doesn’t, you need to play around with the quantities of the products and services you’re selling and their prices until it does.

This will give you a good overview of what it looks like to actually hit your financial goal.

Related Post: How To Break Down Big Goals | The Ultimate Guide

Building a strategy to hit your financial goals for your business

Once you can see how much you need to sell to achieve your financial goal, you can evaluate and determine the strategies you need to focus on in order to make that happen.

I have an entire article on creating a strategic plan for your business, which you can access here: How to Create a Strategic Plan | Entrepreneurs Ultimate Guide

Having a business coach to support you in creating your strategic plan is incredibly valuable.

A fresh set of eyes on your business can help identify gaps you’re not seeing, generate ideas you haven’t thought of, and organize your messy thoughts, feelings, and ideas into a cohesive and actionable plan that you can run with.

And then, your business coach can hold you accountable to executing on that plan even when it gets uncomfortable – one of the most valuable roles for a CEO to have in their business, because we all know you’re not ‘reporting’ to anyone, which means you’re letting yourself off the hook for a lot of things that are preventing you from achieving the kind of growth and success you desire.

Explore what it would look like to work with me as your business coach here and book a discovery call to see if it’s a good fit here. We’ll meet over Zoom and discuss your business goals, challenges, and how I can help you reclaim your time and energy and hit your next level of success and happiness.

Having worked with dozens of entrepreneurs internationally to help them create their success stories, I’d love to support you in your business too.

Tracking Your Money Goals

The final step in the process of setting financial goals for your business is tracking those financial goals in a way that allows you to see and celebrate your progress on a regular basis.

(No, this does not mean waiting until 3 months after year-end to see how much you made when you submit your taxes…)

I recommend you do a financial check in once a month to see your revenue, expenses, and profit.

I like to set up a visual of the specific things/experiences I’m aiming to fund with my financial goals and track progress toward them.

For example, I might have a picture of the trip I want to take, the renovation I want to do, or the team member I want to hire, a corresponding number for how much it costs, and a pie chart for how close I am to being able to fund that goal with the profit I’m making each month.

This technique helps tremendously with motivation and allows you to feel very connected to the financial goals you’re setting for your business.

In fact, the Peak Performance Business Bundle includes a year-end, mid-year, and monthly business review workbook that guides you through regular check ins on all your goals, financial and other, so that you can blow them out of the water, scale your business to the next level, and experience the most fulfilling version of your life.

Take a sneak peek at the business bundle here.

It’s important to set financial goals that have a purpose, actually mean something to you, and support the most fulfilling version of your life. If you don’t take the time to define what that is, you risk building a business that looks good on paper but doesn’t feel right on the inside, and becoming the one in three entrepreneurs that burn out chasing meaningless money.

So, take some time right now to tap into the reason you started this business in the first place, what you want it to provide for you both personally and professionally, and how much that will cost, so that you can build a sales plan and a growth strategy that allows you to make it a reality.

I believe setting purposeful financial goals will allow you to create not just financial success, but Fulfilling Success™ in your life and business. And that’s our exact mission at Ana McRae Coaching: to help entrepreneurs create Fulfilling Success™ in life and business.

I’d love to support you in building the life and business of your dreams so book a discovery call today to explore how 1:1 coaching can change the game for you.

Related Posts: